INVESTORS

C3G supports business in 3 very distinct ways – Advisor, Investor, Managament. The involvement can be as one, two or all three roles and we work closely with our clients to identify and agree where we can add most value. Shown below are brief descriptions of some of our engagements.

Entrepreneur Case Study

Launching A Mobile Payments Fintech

The Idea

Mobile payments are the future with a rapid migration away from cash being seen in developed and developing economies worldwide. A startup fintech who were in the process of developing a platform approached us to help them raise investment.

Cube3Global Experience

Our team has extensive experience in digital payments and was able to undertake a detailed review of the proposition. We worked with the startup team and put together a business plan detailing product build and release as well as investment requirements to have a MVP ready for launch in one of the target markets. We also helped them refine their DevOps manpower requirements in readiness for customisation and launch with new clients.

Network

We demonstrated the mobile app to potential investors and financial services institutions in our network who have all asked to be seed investors as they see the USP and potential traction the fintech will achieve when launched.

Family Office Case Study

Healthy Food Dining Concept

The Idea

A Family Office wanted to diversify into F&B with a specialism in healthy dining but were unsure of starting a new venture or taking over an existing one.

Cube3Global Experience

They approached C3G to help them evaluate options and potential sites in the Central London area. Once a suitable site had been agreed, we developed the business and financial plan to help project the potential growth opportunity of the existing business. This helped the Family Office bring in another co-investor to the project. Our team helped with the design of the seating extension to increase it by 50% and digitisation and integration of the daily accounting with the banking and POS systems thereby reducing administration time each day.

Network

We continue to work with the client to extend the reach of their brand outside of London with strategic product offerings in niche health food diners.

Entrepreneur Case Study

Launching An eCommerce Fashion Retailer

The Idea

An entrepreneur, KA, identified a gap in the market which she saw as an opportunity and entry point to launch a bespoke fashion retailer in her home market.

Cube3Global Experience

Our team worked closely with KA to undertake market research and develop the launch to 3 year strategy, baselining a project plan and ecosystem for revenue and profit growth. By developing the business and financial model, we were able to highlight where investment would be required by KA and allowed her to decide on how much she would seek to raise from investors. We also provided operational support in the first year to ensure KA could focus on revenue growth.

Network

By having a clear investment roadmap, we were able to invest alongside other investors from our network.

Family Office Case Study

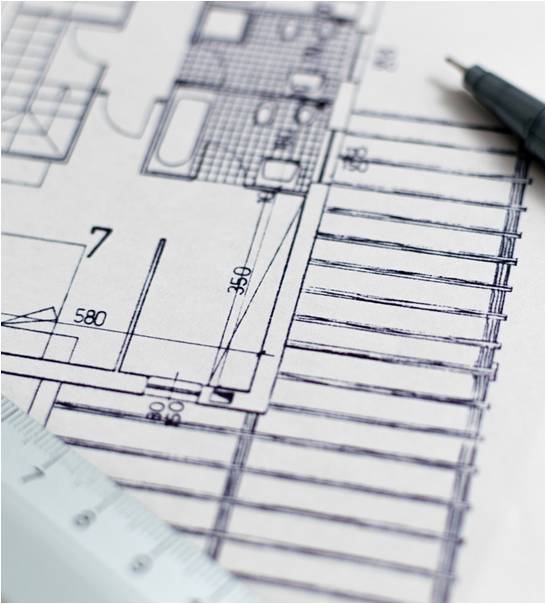

Real Estate Investment in the UK

The Idea

A Family Office wanted to invest into UK real estate on a buy-renovate-lease basis.

Cube3Global Experience

Our team looked at the national outlook for yields and capital gains and recommended to diversify away from London. With agreement from the Family Office, we identified potential opportunities and purchased a suitable investment which would provide a double-digit yield and capital gain. We also oversaw the conversion and renovation from single business premises to 3 flats and a commercial unit.

Network

Our ability to work through our network of Partners allowed the investor to be hands off in the conversion and renovation process going through the entire planning process and overseeing building works. The properties are now managed through one of our Partner’s property management companies who oversee the entire tenant and leaseholder engagement on an ongoing basis.

Investment Group Case Study

International Real Estate Investment

The Idea

An investment group wanted to invest in a long-term international real estate project backed by a well known and reputable brand.

Cube3Global Experience

Our team identified potential investment sites in the chosen country by the investment group. In consultation with the investor, we projected the ROI over a 10 year period based on a buy-hold or a buy-build-lease scenario. We also identified the right plots which would be most marketable and sought after in the long term and agreed on the final selection with the investor. We also invested alongside the investor and now manage the investment on behalf of the client.

Network

Working with our network, we were able to find the most suitable options for the client by being on the ground and engaged with the real estate companies and potential builders. Our detailed valuations brief gave the client the comfort they needed to make the decision to invest.

Family Office Case Study

Fine Dining Restaurant Turnaround and Exit

The Idea

A Family Office owned a fine dining restaurant in Central London but due to it being a non-core part of their portfolio, it had lacked good operational oversight and management leading to poor returns. Our team presented a turnaround and exit plan for the Family Office.

Cube3Global Experience

By taking over management and operational running of the restaurant, our team was able to fully overhaul the restaurants ambience, menu, service and customer base. The turnaround completed and the investment return overachieved, the restaurant was ready to be divested from the family office.

Network

On behalf of the Family Office, our team screened potential investors who wanted to take over the business and negotiated with parties to secure the exit with a significant return above the original plan.